Friday, June 29, 2012

BlackBerry maker RIM posts huge loss and cuts 5,000 jobs

Struggling to fend off competition from iPhone and Android, BlackBerry maker Research In Motion is hemorrhaging losses.

Despite pledges by its new CEO to focus more heavily on marketing and better products, RIM reported Thursday a fiscal first-quarter loss that was greater than expected by analysts and said it'll cut 5,000 jobs.

The Canadian company will also delay releasing BlackBerry 10 -- a new mobile operating system developed to compete with Apple's iOS and Android -- until later this year.

Sales for the most recent quarter plummeted by 43% from a year ago to $2.8 billion. Its net loss totaled $518 million vs. a net income of $695 million a year ago.

"Our first-quarter results reflect the market challenges I have outlined since my appointment as CEO at the end of January. I am not satisfied with these results and continue to work aggressively with all areas of the organization," said Thorsten Heins, RIM's CEO.

About 7.8 million BlackBerry phones and 260,000 PlayBook tablets were shipped in the last quarter, falling short of analysts' estimates. Once the favored phone of enterprise customers, BlackBerry's share in the market totals only about 6.4%, according to research firm IDC. iPhone, with 59% of the market, is the most popular smartphone by far, while Android has 23%.

With its stock down 68% from a year ago, analysts speculate RIM or parts of the company will be acquired. Heins also has hired investment bankers to seek strategic options, though he said earlier this year that finding a buyer wasn't his primary objective. Its stock fell 0.5% down Thursday to end at $9.13.

"The numbers were bad, worse than we hoped," says Jeff Kagan, an independent technology analyst. "And their next generation device, which was expected this fall, now won't be available until next year. They still have customers who love them, but they are simply losing business too quickly." View the original article here

Amazon to allow social features for Kindle Fire games

Amazon is rumored to release tools for game developers that will allow them to add social features to their games. The information comes from Bloomberg, who spoke to an anonymous source.

The report would make sense, as the company has been openly hiring for developers with social and mobile game development experience for over a year. According to Bloomberg’s source, developers will be able to implement features like monitoring high scores and keeping track of awards won in a game.

Allowing developers the option to add social features to their Kindle Fire games could help the device stay competitive with Apple’s iOS devices and the recently-announced Nexus 7 from Google. While the Kindle Fire had strong initial sales, Amazon hasn’t followed up any sales data, so it’s hard to tell if the device has kept up its momentum.

In order to stay competitive, Amazon needs to provide apps with similar features to those already available on the Apple App Store and Google Play (formerly the Android Marketplace), especially since Amazon’s app store only offers roughly 43,000 apps compared to the 600,000+ available by both Google and Apple

View the original article here .

Thursday, June 28, 2012

Facebook Now Lets You “Follow” Someone In Any App, Get Their Updates In News Feed Where The Ads Are

Ads, not payments, are the future of Facebook monetizing mobile, but it needs content to show them beside. The new Follow action announced today could deliver that content by letting you follow someone in a mobile app, and then sending the updates you’d normally see in that app back to your ad-laden news feed.

More content -> more engagement and return visits -> more ad impressions, more money, and more reason for investors to buy. It will send referral traffic to developers, and it’s actually convenient for users too. Why trapse from site to site and app to app when you can see everything your friends are doing everywhere, all from your news feed? You won’t. You’ll sit right there where Facebook can advertise to you.

How Facebook Follow Works

Facebook integrated something similar last week with the Like action, which lets developers take their in-app “heart”, “favorite”, “thumbs up” and other buttons that express affinity, and have them publish stories about the activity to Facebook. That also creates content for Facebook, but only one story at a time.The new Follow action hooks Facebook into an endless stream of updates. As long as the person you follow keeps doing things in the app where you subscribed, you’ll keep seeing their content in the news feed. Privacy is controlled from within whatever app or service you initially clicked Follow. If someone doesn’t want you keeping tabs on their in-app activity, they have to use the app’s settings to make their updates private.

For example, if Instagram integrated Facebook Follow, when you followed someone new on Instagram, you’d get their photos in your Facebook news feed. Some developers might love this, because it would remind people to visit the app.

Some might think of it as Facebook stealing their content, so they might choose not to integrate. Fledgling apps still trying to build their user base and engagement might be more likely to jump on board than premier apps that already have healthy communities. Each developer will have to thoughtfully consider what there goals are in the current phase of their product’s life. If they’re trying to gain users, Follow could help. If they’re trying to boost in-app engagement and their own monetization, they might be better off forgetting Follow.

Here’s how it looks integrated in one app:

Click one of those buttons and you’ll be alerted on Facebook that you’re following someone via your Timeline’s recent activity.

…and your notifications

Then you’ll start seeing posts like these in your Ticker or news feed

Developers who are already publishing stories back to Facebook via Open Graph about who you follow, like Quora for example, have 90 days to either stop publishing their custom “follow” actions and migrate to this new official one, or stop publishing those kinds of stories.

Why Facebook Follow Is So Damn Important

Facebook wants to be the “Omni-News Feed”. Right now content from all the web services and mobile apps are splintered into their respective in-app content feeds. Most sites don’t do a very good job of monetizing that content. But Facebook knows exactly how: Sponsored Stories.If Facebook can maintain its massive time on site (which averages 441 minutes per user per month), it will have plenty of room to inject its Sponsored Stories ads into the news feed.

And it may get even better. I’m checking with Facebook PR, but the actions published could potentially be turned into Sponsored Stories, so Facebook could charge the app where they took place to make the stories appear more prominently in the feeds of people already subscribed to them. Facebook could essentially be taking content from apps and selling it back to them.

If you were wondering what Facebook’s long-term game plan is, you’re staring at it. Pull content from everywhere, mix it with ads, keep you reading. And with the carrot of referral traffic to dangle, some developers may be happy to play along. View the original article here

Wall Street struggling to like Facebook

Facebook Inc may be having trouble connecting with Wall Street.

The financial houses behind Silicon Valley's largest-ever coming-out party kicked off formal coverage of the company today by warning about an uncertain business model, margin pressures and a difficult transition to mobile technology.

The reports, released by banks involved in the IPO after a 40-day quiet period expired, represent Wall Street's broadest assessment of the first US company to debut with a market value of more than $100 billion.

Morgan Stanley and other major brokerages that handled the blockbuster IPO said it remained unclear how Facebook plans to make money from a growing number of users logging on to the No. 1 social network via smartphones and tablets.

That helped send its shares down 3%.

Of the 17 brokerages that handled the blockbuster IPO and kicked off coverage of the social networking company on Wednesday, eight recommended against buying into the shares. Two of Facebook's three lead underwriters - Goldman Sachs and JP Morgan - were most bullish, targeting Facebook shares at $45 and $42, respectively.

Morgan Stanley, which has come under scrutiny for its role in driving a $38 IPO price that now appears lofty to some, stuck to a price target that matched its debut level and "overweight" recommendation.

The average of target prices cited today was $37.64 - a tad below Facebook's stock market debut price.

Facebook's IPO was to have been the culmination of years of breakneck growth for a company that became a social and cultural phenomenon.

Instead, it was marred by a series of trading glitches on its debut, and the company and its underwriters subsequently faced accusations of pumping up the price and inadequate disclosure.

Wednesday's panoply of neutral or equivalent ratings is notable because Wall Street research analysts have a reputation for favoring "buy" ratings, particularly in the high-profile Internet industry where "buy" or equivalent recommendations far outnumber "hold" or lower ratings.

The US Internet sector's 110 companies sport a collective 561 "buy" recommendations or better, versus 352 "hold" or "sell" ratings or their equivalent, according to Thomson Reuters StarMine.

"It says there are real questions out there about the strength of this business model, the fundamental strength of this company, together with its valuation," said Tim Ghriskey, a portfolio manager at Solaris Asset Management.

"We're not buying right now, that's for sure."

How lofty?

Banks are required to keep their employees handling IPOs apart from analysts recommending stocks in order to avoid conflicts of interest.

In the IPO, banks sold their clients shares of eight-year-old Facebook, started by Mark Zuckerberg in his Harvard dorm room, at a price equivalent to a whopping 100 times 2011 net income per share.

That compares with Apple Inc's current multiple of 20.6 and Google Inc's 18.9.

"I respect that a Chinese wall exists, but I think it feeds into the cynicism that Main Street has for Wall Street - that one side of the business was telling them to buy at $38 and the other side of the business now at $32 says we shouldn't buy it," said Steve Birenberg, a portfolio manager at North Lake Capital in Winnetka, Illinois.

Most analysts expect Facebook's large user base to help it corner a substantial share of the Internet advertising market in the long term.

But half of the ratings released on Wednesday were "hold" and its equivalent or lower - despite the shares trading sharply down from their $38 IPO price.

Eight slapped top ratings - "buy," "outperform" or "overweight" - on the social networking company.

BMO Capital Markets' Daniel Salmon began his coverage with an "underperform" recommendation and a $25 target, translating into a nearly 25% slide from current levels.

"Slowing user growth is one of our primary concerns for Facebook's current valuation," said Salmon, the only analyst giving Facebook a negative rating on Wednesday. He estimated Facebook's annual user growth would be 22% next year and 16% the year after, much slower than expansion in the past.

The 33 banks that participated in the stock listing were required by securities regulations to wait until 40 days after the first day of trading on May 18 before publishing their views, limiting the research on Facebook until now to a handful of analysts.

Scott Devitt at lead underwriter Morgan Stanley, who told the firm's major clients that he had cut his revenue estimates on Facebook just days before the IPO, said he expects Facebook's ability to turn its mobile features into profit to be a challenge for the next several quarters to several years.

He expects revenue to climb 31% in 2012, down sharply from the 88% growth in 2011.

"No one is debating the potential opportunity in front of Facebook," said Channing Smith, a portfolio manager at Capital Advisors. "However, there is disagreement in the analyst community on the trajectory of the earnings and revenue growth in the coming years. The assumptions analysts are making are guesswork at this point."

Topsy-turvy IPO

Analysts at JP Morgan set a price target of $45 for the stock, suggesting a rise of 36% compared with its close of $33.10 on Tuesday.

Facebook shares were down 3.1% at $32.07 this morning.

Goldman Sachs set a target price of $42, less aggressive than Morgan Stanley's $38 target.

The company's stock offering, one of the most highly anticipated in history, was marred by a series of technical glitches at the Nasdaq exchange.

Facebook's decision to increase the size of the offering by 25% just days ahead of the IPO, as well as concerns about decelerating revenue, also weighed on the stock, which traded as low as $25.52 before regaining some ground to trade in a $31-$33 range in recent days.

RBC said it expected Facebook's stock to hit $40. BofA Merrill Lynch and Morgan Stanley pegged the shares at $38, while Citi and Barclays opted for $35.

The rush of research comes ahead of Facebook's second-quarter results, expected sometime in mid-to-late July.

With about 900 million users, Facebook has become one of the Web's top destinations, challenging established players such as Google Inc and Yahoo Inc.

Even so, revenue growth from ads and other services is slowing. The company, which last year was more than doubling the amount of money collected every quarter compared with a year earlier, reported growth of 45% in the first three months of 2012, and revenue declined from the preceding quarter.

General Motors Co' announcement a few days before the IPO that it would stop advertising on Facebook has added to the concerns about Facebook's ability to generate business from advertising.

Despite $4.8 billion in expected revenue in 2012, the average amount of money that Facebook makes through each user is still relatively low, said BofA Merrill Lynch, which expects new advertising formats to accelerate revenue growth in the second half of the year.

In recent weeks, Facebook has unveiled a string of enhancements to its advertising service, allowing marketers to target ads to users on the mobile version of Facebook and to show Facebook users ads based on previous websites that they have visited.

"The company is in the midst of a mobile usage transition and we are cautious on Facebook's revenue trends until new mobile ad revenue models start driving the top line," the analysts at BofA Merrill Lynch wrote.

Several analysts working for the underwriters, including Morgan Stanley and Goldman Sachs, cut financial forecasts for Facebook days before the IPO, after the company cautioned about revenue growth due to a rapid shift of users to mobile devices, where Facebook is less effective at generating revenue.

The analysts briefed some institutional clients about their revised forecasts, sources have previously told Reuters, but retail investors were left in the dark.

That revelation has resulted in lawsuits alleging the banks and Facebook failed to fully disclose the company's weakened financial outlook ahead of its IPO. View the original article here

BBC uses Facebook to stream Wimbledon and London 2012 Olympics

The BBC has begun

streaming live sporting events on Facebook, the biggest tie-up to date

between the social-networking site and an international broadcaster.

The application launched on Thursday, with live coverage from the Wimbledon tennis championships.During the Olympic Games, the BBC will run 24 simultaneous streams in addition to the main BBC channels.

Users outside the UK will not be able to access the feeds.

The service used the same "geo-IP blocking solution" to limit access as other offerings, such as the iPlayer, the BBC said.

Other international broadcasters, such as NBC, have set up alternative streaming services - the US broadcaster has teamed up with YouTube to provide live coverage on NBCOlympics.com.

Live chat The launch is the first time the BBC has used Facebook to broadcast live events.

Users are able to share information about what they are viewing with their friends, as well as discuss the action with other fans via a live-chat feature.

Information about what other Facebook friends have been watching appears alongside the video feed

Information about what other Facebook friends have been watching appears alongside the video feed

Targeted advertising, not controlled by the BBC, will appear to the right of the app in line with the Facebook-wide layout. The BBC does not make money from the arrangement.

However, during the Olympics these adverts will be removed due to restrictions put in place by the International Olympic Committee.

More details about the service have been explained in a blog post.

'Favourite moments' Facebook said the BBC's coverage would be added to its London 2012 portal which it announced earlier this month.

"We are really pleased that the BBC has chosen to bring its legendary sports coverage to Facebook," a spokesman said.

"Watching major events such as Wimbledon and the Olympic Games is a naturally social activity.

"Now viewers within the UK have the ability to share their favourite moments with friends and to discuss the action live as it unfolds."

Phil Fearnley, general manager for BBC News & Knowledge, said the app would create a "distinctive live-streaming experience" for viewers.

"We hope to use it to test the benefits of social viewing, as part of our ambition to deliver more innovative and transformative experiences to sports fans," he said.

The BBC said there were no plans as yet to bring other live events, such as news, to the social network. View the original article here

Apple posts $2.6 million bond to begin preliminary injunction on Galaxy Tab 10.1

Earlier this week there were reports that District Judge Lucy Koh issued a preliminary injunction on the Galaxy Tab 10.1 in the U.S. related to the ongoing cases between Apple and Samsung. At the time reports claimed the ruling would kick in once Apple posted a $2.6 million bond, and today FossPatents reported that Apple has since done so, allowing the preliminary injunction to formally take effect:

Apple didn’t hesitate to post its $2.6 million bond to protect Samsung againt the possibility of a successful appeal, in which case the preliminary injunction would be found to have been improperly granted… the injunction has taken effect and Samsung must abide by it. Otherwise Apple could ask the court to sanction Samsung for contempt.With Apple pulling in $39.2 billion in revenue last quarter, we know it takes only a matter of minutes to make that $2.6 million, which is meant to protect Samsung from damages in the event the injunction is found to be wrongly issued. On Tuesday Judge Koh made a statement following her ruling that Samsung “does not have a right to compete unfairly, by flooding the market with infringing products.” FossPatents continued by giving its outlook for the trial set to take place this summer:

I have previously stated my belief that Apple goes into this summer’s trial with a fundamentally stronger case than Samsung. That belief is mostly based on the strength of the asserted intellectual property rights and the fact that Samsung mostly relies on FRAND-pledged standard-essential patents (SEPs)… Apple won’t be able to prevail on each and every intellectual property right it asserts, but I think Apple will at least win parts of its case while Samsung will at best win a FRAND royalty but no injunction over SEPs. View the original article here

Wednesday, June 27, 2012

Apple iPhone 5 will be the NFC 'iWallet' rumor claims

NFC (Near Field Communications) might indeed be on its way within iPhone 5, the latest Apple [AAPL] rumor claims, but will the company get it right this time, or will it repeat the standards-based drama of the iPad 3 LTE debacle?

[ABOVE: One of the many NFC-related Apple patent filings, c/o Patently Apple.]

Cracking the code

There's been lots written about Apple's adventures in NFC. This isn't the first time we've been told to expect NFC support within a future iPhone, but merely because the developer beta iOS 6-exploring sleuths at 9to5Mac have uncovered references to it within the code doesn't definitively mean Apple will deliver it.

Or does it?

Writing last year, Forbes' Elizabeth Woyke told us: "From what I hear, it is possible the iPhone 5 will include NFC. An entrepreneur who is working on a top-secret NFC product told me today that he believes the iPhone 5 will have NFC and cited a friend who works at Apple as a reliable source for the information."

Reading through previous reports there's a huge body of evidence to support these claims.

Some risks

So what is NFC? In brief, it's a short range communications standard that aims to securely transmit information to a contactless payment terminal.

There's some problems within implementation. NFC is a set of standards, and the standards sub-set used to support it in some countries and by some operators is different in different places. This has delayed wide-scale adoption of the technology, meaning previous attempts to make it pervasive made so far (Google Wallet, for example) have failed.

Those with interest in the space have been working quite hard to grapple with this problem. Visa, for example, has put together its own reference points for international NFC support.

Should Apple choose to offer NFC within iPhone 5 the company will -- I hope -- ensure international support from the get-go. Indeed, I urge Apple to do just that -- there's no point flagging up use of your iPhone as a wallet to the device's international market if the feature only works in the US.

That's the kind of marketing which has cost the company millions in fines for lack of support for 4G/LTE networks outside of North America in the case of the iPad 3.

The hidden antenna

A June 2009 Apple patent revealed it has developed a method for building an NFC (Near Field Communictions) antenna into a touch screen. The 'touch screen RFID tag reader' patent application explains that:

"The antenna can be placed in the touch sensor panel, such that the touch sensor panel can now additionally function as an RFID transponder. No separate space-consuming RFID antenna is necessary."

The next iPhone OS iOS 6 includes a feature called Passbook. This is designed to be an intelligent folder within your phone which will carry your gig tickets, airline tickets, boarding passes and shopping coupons. While NFC support has not been announced, many think this feature will eventually emerge as Apple's answer to Google Wallet.

"We've developed templates to make it really easy for all you developers to build these great passes and tickets and it integrates right in with the lock screen. So, when you get to the movie theatre, your ticket automatically pops up on the lock screen. Slide across here, scan it in, go in," said Apple's iOS chief, Scott Forstall, introducing Passbook.

Passbook puts Apple head-to-head against Google (and in future, Windows 8), as the search engine company is expected to announce Google Wallet 2.0 at Google I/O this week. The company recently acquired a company called TxVia, which offers pre-paid accounts which will be tied to Google Wallet in order to enable more users to actually conduct mobile payments.

iTunes as a virtual bank

Apple has a similar model to follow: iTunes. Apple could link its NFC payments approval process up with a user's iTunes account. Users would then be able to set a payment limit ($25, for example) and use their device to pay for goods and services.

It is possible the future plan to link iPhone 5 NFC payments up with iTunes is why Apple mentioned its existing 400 million credit card-using iTunes accounts at WWDC this year. The advantage of using iTunes as a payment processing account would be to protect a user's actual credit card information from theft and enabling users to set payment levels they felt comfortable with.

It is also worth noting Apple's move in 2011 to quietly begin trials in which iPhones are used as wallets inside its retail stores (image above).

Another patent of note: April saw an Apple patent for a gifting service which seems based on NFC. The company has filed numerous patents which could easily relate to the creation of an NFC-based iPhone ecosystem.

It's worth noting that Apple hired Benjamin Vigier as its Apple's Mobile Commerce Manager. This man has huge experience in the NFC field, including stints at Starbucks and PayPal.

Speaking at the 2012 Air Transport IT Summit, SITA CTO, Jim Peters, observed: "Opinion is that Apple is going to incorporate NFC into Passbook. Apple just thinks about how they can make it really easy for the user, and then they figure out how to monetize it. They don't think about how to monetize it and then tell the user what they can have. It doesn't work like that."

The technology goes far beyond payments. The disruptive technology has potential impacts across other sectors, too, air travel, for example: "Boarding passes are going to be the next step with this technology," said SITA's Peters.

Visa, Mastercard, Apple and the NFC roll-out

MasterCard's Ed McLaughlin has also hinted at Apple's plan to turn your iPhone into a wallet. "I don't know of a handset manufacturer that isn't in the process of making sure their stuff is PayPass ready," he said.

When asked whether that included Apple, he replied: "Um, there are… like I say, [I don't know of] any handset maker out there. Now, when we have discussions with our partners, and they ask us not to disclose them, we don't."

The prize is huge. NFC mobile payments will exceed US$180 billion worldwide in 2017, according to a May 2012 report by Juniper Research.

"NFC technology is transforming mobile phones into payment devices that will change the way people live, work and play," said Niki Manby, head of emerging products, Asia Pacific, Central Europe, Middle East and Africa, Visa. "NFC payments have enormous potential and we are committed to providing the convenience of this technology in a secure manner to our customers."

With or without NFC, Apple is expected to introduce its next-generation iPhone in Fall, scooping profitable leadership of the industry.

Got a story? Drop me a line via Twitter or in comments below and let me know. I'd like it if you chose to follow me on Twitter so I can let you know when these items are published here first on Computerworld.

View the original article here

After 5 years, Apple's iPhone has generated $150B in revenue

This week marks the fifth anniversary of the launch of the first iPhone. Since then, Apple's smartphone is estimated to have generated the company $150 billion of cumulative revenues worldwide.

The first iPhone officially launched on June 29, 2007, making this Friday the official five-year anniversary. Recognizing the milestone, Strategy Analytics on Wednesday offered its latest statistics, noting that Apple has shipped 250 million iPhones cumulatively worldwide, generating $150 billion in cumulative revenues.

"The iPhone portfolio has become a huge generator of cash and profit for Apple," said Neil Mawston, executive director at Strategy Analytics. "A quarter of a billion iPhones have been shipped cumulatively worldwide in the first five years since launch and Apple reaches its fifth birthday at the top of its game."

While the first five years of the iPhone have been an undeniable success for Apple, propelling the company to become the largest in the world by market capitalization. But Mawston said the next five years could be more difficult for Apple, as the competition improves and some mobile operators become concerned about subsidies spent on the iPhone.

Currently, the iPhone is so popular that Apple sells more handsets per day than there are babies born in the world, according to VoucherCodes.co.uk. The retail outlet also noted that since the release of the iPhone, Apple's worldwide brand ranking has catapulted from 44th place to No. 1.

The first iPhone was introduced in early 2007 by Apple co-founder Steve Jobs as three devices in one: a "revolutionary mobile phone," a "widescreen iPod," and a "breakthrough Internet communications device." Since then, the iPhone's upward trajectory has been consistent, as Apple continues to deliver record breaking quarters and sales continue to grow.

In the last quarter alone, Apple shipped 35.1 million iPhones, helping to propel the company to the 250 million milestone that Strategy Analytics believes the company has crossed ahead of the iPhone's five-year anniversary. In its last quarterly earnings conference call, Apple executives announced that more than 360 million iOS devices, including the iPhone, iPod touch and iPad, had been sold to date View the original article here

'Apple concept stocks' higher on iPhone 5 early launch date

Taipei, June 27 (CNA) Shares of Taiwanese suppliers to Apple moved higher Wednesday morning after the local media reported that the U.S. consumer electronics giant will unveil its iPhone 5 in August, a couple of months ahead schedule, dealers said.

With the expected early launch of Apple's newest smartphone model, hopes have been raised that Taiwan's contract makers will enjoy an increase in shipments and higher profitability for the second half of this year, dealers said.

As of 11:12 a.m., shares of casing supplier Catcher Technology Corp. had risen 2.86 percent to NT$197.50 (US$6.61), and cell phone camera lens maker Largan Precision Co. had climbed 4.82 percent to NT$609.00.

Cell phone camera lens supplier Genius Electronic Optical Co. had gained 2.78 percent to reach NT$240.50, while shares of Hon Hai Precision Industry Co. were up 0.70 percent at NT$86.60 although the gains were capped by worries over the losses on its investment in the Japanese company Sharp.

The weighted index was up 0.77 percent at 7,192.70 points on turnover of NT$29.40 billion..

"The market has been waiting for the new iPhone so the reports stirred up buying in these Apple concept stocks this morning," MasterLink Securities analyst Tom Tang said.

Apple is expected to place orders with component makers in July in preparation for its planned launch of iPhone 5 in August, which is aimed at cashing in on back-to-school buying at the end of the summer vacation, according to local media reports.

While component suppliers such as Largan and Genius will benefit from the strong demand from Apple, Hon Hai is likely to serve as the sole assembler of iPhone 5, the reports said.

"After recent consolidation on the broader market, investors tended to seize any leads, whether positive or negative, to trade and the reports prompted buyers to return," Tang said.

"However, I prefer to advice investors that they should trade these Apple concept stocks with caution as the global financial markets remain overshadowed by lingering concerns over the debt problems in the eurozone," Tang said.

Tang said he is afraid that demand for iPhone 5 in Europe and the U.S. will be compromised by a weakening global economy caused by the European debt crisis.

"The current interest in Apple concept stocks reflects hope rather than reality," Tang said. "It is possible that many investors will sell these stocks for trading purposes and will lock in their profits soon." View the original article here

Facebook’s Hidden “Like” Isn’t Just Good For Mobile Developers, It’s Good For Facebook

Last week’s announcement from Facebook about the new ability for app developers to integrate a hidden, built-in “Like” button in their mobile applications seemed to fly under the radar. Not that it wasn’t duly covered by tech press: it was. But the deeper implications seemed to have been summed up under the banner of “this is great news for app developers”-type sentiment. It is, of course. App developers who smartly leverage Facebook integration can achieve impressive growth, even if it’s a bit manufactured at times. But more importantly, the move is great for Facebook. It has managed to introduce a toolkit that allows developers to weave Facebook’s data collection capabilities deep into the fabric of the future Internet - that is, the world of mobile apps.

First, some background. Smartphone adoption is growing at an incredible rate. Over half of the U.S.’s mobile population now owns a smartphone. Worldwide, the potential addressable markets are huge: China has 122 million users who could afford an iPhone or Android. The U.S. has 91 million, India 75 million, Japan 65 million and Brazil 34 million.

According to KPCB’s Mary Meeker, global mobile Internet traffic is also rapidly growing, and has now reached about 10% of all Internet traffic. 71% of the revenue in mobile is coming from apps, but only 29% from ads (and only 1% of U.S. ad spend currently goes to mobile). But Meeker believes that it’s only a matter of time before mobile monetization catches up.

These numbers are important to provide context. Namely, that we’re shifting into the post-PC era, a time when the way we interact with the web, with online services, and with technology as a whole, is changing. The PC era was defined by a computer in every home and then a web browser. Later, with “web 2.0,” there came a group of online applications that provided richer interactions than the static pages of the past. Meanwhile, information discovery and retrieval in the PC era evolved from online directories to search. It’s now poised to evolve yet again.

Google was – and, still is – an incredible innovation. Billions of webpages, and it knows which ones we want to see first. However, our reliance on Google.com’s search has the potential to fade somewhat in the post-PC era. A blank box, type in text, hit enter, read results, see related ads? Mobile users will operate differently. We will query up data from within an un-indexed web – the web of apps. Movie showtimes? Weather? News? Friends’ updates? Yes, this information is available on the web, but users will find the details they need by launching apps, or talking to virtual assistants like Siri who then launch the apps for them. So how does an advertising-focused company – Facebook or Google – surface a user’s intentions and interests in this app era, outside of explicit search queries? It starts to track you in the apps, of course.

Facebook’s Open Graph, an arguably bigger player in the mobile-first future, allows Facebook to record what people are doing, and then infer what they like and what they would then want to know, based on those actions. You “played” a song in Spotify, you “read” an article, e.g. Then you clearly like Lady Gaga or reading about Politics. Right? Well, maybe. That’s a fascinating data set of user behavior, but there’s still something to be said for the explicit “Like.” It holds a different meaning. It means you not only saw/read/interacted with the content, as the Open Graph actions indicate, but you also approve/agree/support/feel good about it.

But the Facebook “Like,” still relatively new in the grand scheme of things, has already become synonymous with “market to me in my News Feed.” The decision to press the seemingly innocuous thumbs up now holds a meaning that even less technical folks have come to understand. It’s the modern equivalent of “add my name to your email distribution list.” (So far we’ve come, so little has changed.)

That’s why the “hidden” like is so interesting. It’s integrated seamlessly into the application. You’re not “Liking” a Facebook Page, you’re “Liking” an Instagram photo. And it’s not a thumbs up icon – it’s a little heart…or whatever else the developer sees fit to use. The point being: it looks like part of the app itself. It will become impossible to tell (without reading all the pop-up disclaimers and EULAs – and who does?) which in-app actions will live within the app and which populate Facebook. And that’s the idea. That’s how they getcha.

Another reason why the hidden Like is important: it allows for data collection surrounding apps’ more passive users. If you believe in the 1% rule, content creators only account for 1% of a community. Not everyone will read, watch, post, create, etc., as the Open Graph actions allow for. But a fair number will still interact – i.e., “Like” – the content others are creating in the apps. And the hidden like allows that data to be tracked.

In a (not-so-distant?) future, you can see where this is headed, in terms of advertising. A user “Likes” Instagram photos of beaches and sunsets. The user then sees ads for vacations and cruises on Facebook. A user “Likes” a friend’s Starbucks check-in in Foursquare, but has never “Liked” Starbucks’ fan page on Facebook. Now Starbucks knows to show them ads and deals. It’s the re-creation of the tracking cookie’s capabilities in a “web” where people surf mobile applications, not websites. And what could it become? The possibilities are mind-boggling. You “Like” photos of beaches, you launch a travel app to book plane tickets for a work trip and find Caribbean vacation packages are now on sale. Coincidence, or “Like” tracking? You may not know, but what’s even better, is that you may not care. View the original article here

Android 4.1 Jelly Bean Confirmed Ahead Of Google I/O

Even though there were a lot of speculations regarding the cake name associated to the new version of Google’s mobile operating system, the search engine champ itself has confirmed the name of Jelly Bean, a few hours ahead of the Google I/O event.

The creators of Android have place a Jelly Bean jar statue in the park near Google headquarters in Mountain View, therefore confirming the name of the new OS version. Besides the symbols of the old versions, as you can see in the picture above, for Jelly Bean, Google installed a jar full of colorful jelly beans. We don’t know yet why the jelly beans are spilled all over the place, but this is another story.

Considered for a long time the next major Android iteration, Jelly Bean is in fact Android 4.1, instead of 5.0, as the Google Play screenshot below reveals. You can actually see the Galaxy Nexus HSPA+ with Android 4.1 Jelly Bean, and even though the picture doesn’t have the best quality, it manages to show some of the features of the new OS. You can spot a new default wallpaper and a new search button with a new design.

Rumor has it that the first device running Android 4.1 Jelly Bean out of the box will be unveiled at Google I/O, the highly anticipated Nexus 7 tablet, manufactured by ASUS. They say that the Google Nexus 7 will sport a 7-inch display, 8/16 GB of internal storage, camera and a quad-core Nvidia Tegra 3 tablet. Reports say that the price of the 8 GB model will be $149 while the 16 GB version will cost as much as $199.

It’s obvious that Google was inspired by the success of Amazon’s Kindle Fire and now the Mountain View-based company is trying to bite a big chunk of the market share pie. The battle on the 7-inch tablet market segment is becoming interesting with rumors pointing that the online retailer is readying a successor for their Kindle Fire, while Apple is reportedly planning a 7.85-inch iPad Mini. View the original article here

Google Created The First Machine That Is Capable Of Learning

The efforts of a team of scientists, hired by the famous Google X Labs, have been successful in the direction of crating the first artificial brain, capable of learning from its own experience.

Rather famous for inventing the self-driving cars and for the Google Project Glass (augmented reality glasses), the scientists of Google X Labs are currently working on an new, highly-ambitious project, that attempts to create a virtual replica of the human brain, capable of learning.

In order to reach their goal, the Google researchers have created an artificial neural network, based on a processing machine that has 16,000 interconnected processors and underpinned by a specialized experimental software. The prototype that resulted was then connected to the network and let run free on the internet, while the researchers team monitored the results and its behavior.

Among others, during the experiment the neural network learned how to identify cat pictures, accurately extracted from a collection of over 10 billion miniatures created using Youtube videos. The results seem to support the biologists’ theories that suggest that the brain’s neurons have a natural ability to identify specific objects.

What is really remarkable is that the scientists haven’t introduced any information into the neural network, without suggesting it what to find. The system independently invented the “concept of cat,” without any information coming from outside.

In the first instance, the machines capable of learning can be used in the search engine field, improving the relevance and accuracy of the results provided for the semantic searches – when the users are basically asking questions in the search engine, receiving relevant responses for the context, instead of words used as web search query.

Improvements can also be brought to the translation algorithms, voice recognition systems, translating conversation from one language to another and face recognition systems. View the original article here

iPad Mini surfaces, Apple to soon launch iOS6

New pictures of the iPad Mini has surfaced and it is now being speculated that that apple could launch the smaller version of its iPad sooner than October.

Zoogue.com that manufactures and sells iPad covers has released the latest pictures on its blog just days ahead of Apple’s WWDC 2012.

According to the blog the iPad Mini or the iPad Nano as it could be named, the display might only take a 7.58 inch form factor and not 7.85 inch as it was previously believed to be.

The dock connector for the new mini pad could also change in tune with that of the new iPhone.

Last week we had reported details about new iPhone designs that has a much smaller syncing and charging port compared to the 30 pin dock port that is currently being used in iPhones, iPads and iPhones.

Leaked images on the tech blog 9to5Mac showcases a new metal back cases of the new iPhoneapart from changes to the positioning of the earphone jack moving to a corner at the bottom of the case.

Apple to launch iOS6 at WWD 2012

It has now been confirmed that apple will indeed announce its iOS 6 software during the Worldwide Developers Conference.

According to MacRumors, another technology blog that extensively reports on apple, a banner on display at the venue of the WWD 2012 provides enough indication that iOS 6 would be launched during the event.

"The banner also displays a silver-coloured theme that has been rumoured to making its way to the iPhone to replace the blue theme present in many of Apple's apps..... With Apple having dropped numbering and other descriptors from its latest model of the iPad earlier this year, there has been speculation that the company may follow suit with other products such as the iPhone. Today's banner indicates that the company will at least continue marketing iOS using its version number," the blog report said.

Meanwhile, reports have also emerged that Apple could announce its iPad Mini and the new iPhone 5 sooner than October. However it is still not clear how soon it could be. View the original article here

Tuesday, June 26, 2012

Facebook tip: How to turn on (or off) individual email notifications

Jhesa writes: How can I receive individual Facebook email notification again, instead of that summary email notification that I’m receiving? I’m much more comfortable with the individual email notifications, especially since Facebook access is blocked at my company.

Greetings, Jhesa! If you want Facebook to shoot you an email each time someone posts a message to your timeline, comments on one of your status updates, “likes” a photo you’re in, or otherwise does something related to your profile, all you have to do is change a key account setting.

But here’s the thing: you should also take some time to tweak your notification preferences, or else you may wind up buried in a pile of Facebook emails.

Here’s what you do:

- Click the little downward arrow in the top-right corner of any Facebook page, then select Account Settings from the pull-down menu.

- Click the Notifications tab in the left column, then find the gray “Email Frequency” box at the top of the page.

- Want to start getting individual email notifications from Facebook? Then clear the “Email Frequency” checkbox. If you just want the occasional summary email, make sure the box is checked.

- If you un-checked the box, your next step is to customize your Facebook notification settings—and be warned, there are a lot of them. Start by looking at the notifications in the “Recent Notifications” section, and toggle the email icon for each depending on whether you’d want an individual email alert for a specific event.

- Next, check out the “All Notifications” sections, and start clicking the Edit links next to the various categories (such as “Facebook,” “Photos,” “Pages,” “Wall Comments”). Within each category, you’ll find a series of checkboxes covering just about any Facebook event imaginable. Just check or clear the checkboxes as you see fit.

- Last but not least, you can change the email address where Facebook sends your notifications by clicking the General tab in your account settings. From there, click the Edit link next to the Email heading, then select or add a new primary email address.

Bonus tip

One way to keep your Facebook email notifications under control is to filter incoming Facebook messages into a special Facebook folder in your email account.

In Gmail, for example, you can create a filter from the Mail Settings menu; just select the Filter tab, click the “Create a new filter” link, type “Facebook” into the “From” field, check the “Apply the label” checkbox, select “New label” from the pull-down menu, then create a new label called “Facebook.” View the original article here

How to permanently delete your Facebook account

Had it up to here with Facebook? You can always delete your account, but it’ll require a little work—and patience—on your part.

First, we need to make a clear distinction between merely “deactivating” your account and actually deleting it.

Deactivating your Facebook account is a fairly quick and easy process, but it will only hide your profile and personal information, not wipe it completely off of Facebook’s servers.

To deactivate your account, visit the Security Settings menu (click the down-arrow in the top-right corner of the screen, select Account Settings, then click Security in the left column), click the “Deactivate your account” link, and follow the prompts. Change your mind? Just log back into Facebook, and your profile will be waiting for you.

But what if you want to delete your account completely—and permanently? You can, but you’ll have to jump through a few more hoops, and the process isn’t instantaneous.

Here’s what you do:- The first step is actually finding the link for deleting your account. One way is to search for “delete account” in the Facebook Help Center, or you can just click this link.

- Next, you’ll come to a page warning what will happen if you delete your account—namely, that once your account is deleted, you won’t be able to recover your information. Ready to continue? Click the “Delete My Account” button.

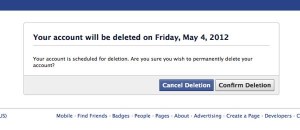

- A pop-up window will appear with yet another warning: “You are about to permanently delete your account. Are you sure?” You’ll then have to enter your Facebook password, then enter a “captcha” security code (a cluster of random text, intended to make sure you’re not a malicious spambot).

- All done? Click the “Okay” button, then check your inbox for an email confirming that you’ve requested that Facebook permanently delete your account.

- Now comes the time-consuming part. Facebook won’t delete your account right away—indeed, you’ll have to wait a full 14 days for your Facebook profile to be erased forever. If you have second thoughts during your two-week wait, you can log back into your account and click the “Cancel Deletion” button.

- One more thing: Even after Facebook has officially deleted your account, keep in mind that some of your information may remain on Facebook’s backup servers for up to 90 days. After that, though, your profile and other personal data should be completely wiped off Facebook. View the original article here

You'll have two weeks to change your mind after asking Facebook to delete your account.

Intel aims for Augmented Reality chips

According to Reuters, the sort of technology involved overlays text or graphics on real-life images and objects. This allows a hybrid image to be viewed on a smartphone, tablet or PC screen - or even dedicated specs.

Maarten Lens-FitzGerald, co-founder and general manager at Layar, said that the cash meant that he could talk about business models and products.

The company software has been downloaded more than 20 million times and is the world's most used consumer AR application.

This is a reality browser that helps find services nearby, acquiring info on anything from restaurants to networking opportunities via a mobile camera.

Intel has to move fast.

Qualcomm, the top wireless chip maker, has bought up AR assets and opened its platform for software developers in 2010. ARM is also adding AR features to its designs. View the original article here

Motorola ATRIX 3 listed on Bluetooth SIG

In the U.S., the Motorola MB886 is the Mototola ATRIX 3 while elsewhere the phone will go by the Motorola Dinara moniker. It's hard to believe that we are already on the third iteration of the ATRIX series. It seems like just yesterday when Motorola rolled out the dual-core powered smartphone, calling it "the world's fastest smartphone," a statement that got ads for the device banned in the U.K. What got us thinking about the Motorola ATRIX 3/Dinara was the word that the handset had been approved by the Bluetooth SIG following a successful visit to the FCC.

The Motorola MB886 will feature a touchscreen with HD720p resolution with a Qualcomm dual-core S4 processor under the hood and 1GB of RAM aboard. The camera will be a major focus here with a 13MP sensor. There will also be a front-facing shooter so you can take self-portraits for the egotist in you, and enable video chats. The Motorola ATRIX 3 will also launch with Android 4.0 installed and feature both LTE and HSPA+ connectivity. We should see this tagged at about $199.99 with a 2-year pact with a launch via AT&T as soon as next month View the original article here

Windows Phone 8′s Clock is Unreadable

There has been a bit of conflict lately over the new Windows Phone 8 Start screen that was announced last week along with a few other developer features. Some like the current Windows Phone 7.5 start screen because of its asymmetric aesthetics and uniform structure, while others are excited to have greater flexibility in the sizes and arrangement of live tiles in Windows Phone 8. The empty right edge of the old Windows Phone 7.5 actually had a few uses… it was a necessary area for deactivating or applying the tile customization mode, it housed the visual cue to access the app list, and it also left a nice black area for the clock to sit so that the time was readable no matter what part of your start screen you were looking at. All of those advantages are gone with the new start screen design in Windows Phone 8, and as you can see in the above photo from Wednesday’s announcement, the clock is no longer consistently visible or readable. You have to get the start screen scrolled all the way to the top so that it overlaps a black area in order to see it. Or you need to keep some dark-colored tiles on the right side. This may not be a huge problem since you’ll most likely still see the clock in a larger font on the lock screen, but still it feels like the genius design of the original Windows Phone 7 has been degraded. Hopefully this can be fixed before the final OS ships… perhaps in a different way.

Do you care about seeing the time on your start screen or is it really not that important? View the original article here

Microsoft Windows Phone 8 leaves Nokia in fragments

Changes to software mean that even the latest mobile phones can be out of date within months. Matt Warman reports.

In January, Stephen Elop, chief executive of Nokia,

announced the company’s flagship handset. The

Lumia 900 was considered the exemplar of Microsoft’s new operating

system, Windows Phone. This week, just six months later, Microsoft

announced a major Windows Phone update that it said would not be

available to Lumia 900 owners. Nokia sold two million Lumia handsets in the

first quarter of 2012 but the company's top device has essentially been

rendered out of date within a year.

The move highlights the pace of technology developments, especially in mobile

phones, but it also emphasises the growing problem of so-called

‘fragmentation’. This means that relatively new devices are often unable to

run the latest version of the software that powers them. For software

developers, fragmentation means they can’t be sure how, or even if, their

applications will run successfully on the latest handsets.

Part of Apple’s dominance of the smartphone app market can be explained by its

approach to limiting fragmentation. While a few of the latest features

are limited to the most recent handset, Apple typically ensures that the

latest version of its iOS software is compatible with iPhones that are up to

two years old. The fact that the company releases just one iPhone per year

makes this task a little easier.

For Android, the situation couldn’t be more different: according to analysts

at CCS Insight, “chief among Android’s challenges is fragmentation: the

splitting of Android into multiple incompatible variants. This has

significant repercussions for users, developers, network operators,

manufacturers and Google itself.

"We believe Android fragmentation falls into two categories: splits that

come about through Google's own actions in releasing new versions and those

driven by third parties like Amazon, Baidu and Barnes & Noble releasing

their own versions. Both are prompting overall fragmentation within the

Android ecosystem.”

Now, the same problem is coming to Windows Phone. While Microsoft points out

that the major shift in software will bring huge improvements, it also

concedes that for some time shelves will carry a range of devices labelled

‘Windows Phones’ that are in fact fundamentally different. The idea of some

models being more equal than others is not attractive for manufacturers

trying to encourage reluctant users away from Google and Apple. For Nokia,

sales down more than half in the first quarter, it could be critical.

Indeed, according to leading retailer Carphone Warehouse, the mobile phone sales pitch is now based far more on a phone’s software than it is on its physical functions. Where previously the market was divided into, for example, good cameraphones and music phones, now it’s all about the operating system.

Graham Stapleton, the firm’s Chief Operating Officer, argues: “What was once a battle of hardware between the manufacturers, has now become a battle of software. Both customers and developers can look forward to reaping the benefits in the coming months, as Windows Phone 8 brings some much needed variety and depth to the market."

He continues: “There are some very exciting devices due this autumn sporting the new operating system, and they will be fundamental to its success.” By implication, the existing devices are now far less attractive because they will soon be usurped.

As Informa analyst Malik Saadi put it on his blog: "Operators and users will hold on until the new devices are in the market this coming autumn. This will have a serious impact on Nokia's financial performance this quarter."

For consumers, it makes the issue of when the best time to buy a new phone is significantly more tricky. Nobody, after all, wants their phone to be in fragments within months of buying it. View the original article here

Indeed, according to leading retailer Carphone Warehouse, the mobile phone sales pitch is now based far more on a phone’s software than it is on its physical functions. Where previously the market was divided into, for example, good cameraphones and music phones, now it’s all about the operating system.

Graham Stapleton, the firm’s Chief Operating Officer, argues: “What was once a battle of hardware between the manufacturers, has now become a battle of software. Both customers and developers can look forward to reaping the benefits in the coming months, as Windows Phone 8 brings some much needed variety and depth to the market."

He continues: “There are some very exciting devices due this autumn sporting the new operating system, and they will be fundamental to its success.” By implication, the existing devices are now far less attractive because they will soon be usurped.

As Informa analyst Malik Saadi put it on his blog: "Operators and users will hold on until the new devices are in the market this coming autumn. This will have a serious impact on Nokia's financial performance this quarter."

For consumers, it makes the issue of when the best time to buy a new phone is significantly more tricky. Nobody, after all, wants their phone to be in fragments within months of buying it. View the original article here

Samsung predicts record-breaking Galaxy S3 sales, despite supply problems

Samsung expects sales of its new Galaxy S III, launched at the end of last month as a main rival to Apple's iPhone, to top 10 million during July, making it the firm's fastest selling smartphone.

Samsung also predicted its second quarter earnings will beat its results for

the first three months of 2012, countering market concerns that tight

supplies of the new Galaxy model and the weak global economy would hit the

South Korean giant's bottom line.

Samsung kicked off global sales of its Galaxy SIII on May 29, but shipments

have been affected by the tight supply of parts such as the handset casing

for the pebble-blue model.

In the United States, where sales were launched last Thursday, major carriers

including Sprint Nextel, T-Mobile and AT&T have not been able to offer the

Galaxy SIII with 32 gigabytes of memory, partly due to tight supply.

"We're getting far better reviews on S III than we did with its predecessors

globally ... and supply simply can't meet soaring demand," said JK Shin,

head of Samsung's mobile division.

"We've sent executives and staff to almost all our (component) suppliers to

ensure a smooth offering and hopefully things will get better from next

week."

Samsung launched its first Galaxy model two years ago in a rush to counter

Apple's iPhone success. Then, Samsung's smartphone market share was below 10

percent. It has since overtaken Apple, and the company said in late April

that new Galaxy smartphones would "substantially contribute" to

second-quarter results.

Samsung sold 44.5 million smartphones in January-March - equal to nearly 21,000 every hour - giving it 30.6 percent market share. Apple sold 35.1 million iPhones, taking 24.1 percent market share.

View the original article here

Samsung sold 44.5 million smartphones in January-March - equal to nearly 21,000 every hour - giving it 30.6 percent market share. Apple sold 35.1 million iPhones, taking 24.1 percent market share.

View the original article here

Analyst predicts Apple iPhone 5 to be a true world phone when launched

With the Worldwide Developers Conference out of the way and Apple successfully unveiling their MacBook Pro with a Retina Display, all eyes are now focusing on the brand’s next hardware announcement, which is highly expected to be that of the iPhone 5. Since Apple stuck with the same design for the iPhone 4S, a lot of talk surrounding the design of the upcoming iPhone has been surfacing. However, there is also interest generating as to what other features will be thrown into it. Commenting on this is a report by CNET, which states that the next iPhone will be a true 3G/ 4G world phone, along with having significant improvements over the iPhone 4S.

The report states, “The sixth-generation iPhone is expected to sport three big improvements, says analyst Shaw Wu. Picking up intel from suppliers, Wu sees a new form factor, a slightly larger screen, and 4G LTE support built into Apple's next flagship phone. These features should help the upcoming iPhone outscore the iPhone 4 and 4S at picking up new customers and enticing existing ones to upgrade.”

There has been a lot of talk about iOS 6 and how it will benefit China. The country has the biggest smartphone market in the world and Apple plans to offer services that cater specifically to the country. At the Worldwide Developers Conference, Apple had announced that Siri could now understand Mandarin and Cantonese, so one would expect the iPhone 5 to adopt specifications that can work well on a global scale and not just cater to the U.S audiences. According to the report, “The phone (iPhone5) will work with China Mobile's proprietary TD-SCDMA 3G network, says the analyst. Both China Mobile and China Unicom have been testing 4G LTE. But full adoption of LTE is a few years away, so support for 3G is crucial if Apple is to gain further traction in the Chinese market.” Wu goes on to state that by combining iOS 6 with the iPhone 5, Apple will be a few steps closer to offering the iPhone on China Mobile.

The other major news surrounding the upcoming iPhone pertains to the redesign that it is expected to feature. The screen size of the iPhone has remained the same, since it was first launched. Apple is expected to increase the size of the display to 4-inch diagonally. While the width will not change, the brand will raise the height, thereby giving it an resolution of 1136 x 640.

Other major changes include the relocation of the headphone jack from the top to the bottom, the redesigned speaker grille and the connector dock. With the possible change in design, we can also see that Apple will change the design of the dock connector at the bottom and it will be a lot smaller in comparison. This change is believed that is to be implemented is done in order to fit the handset with LTE capabilities. View the original article here

iPhone 5 prototypes reportedly reveal NFC support

Details obtained from early iPhone prototypes by 9to5Mac suggest that the new phone will include the necessary hardware to enable near field communication.

The next iPhone could let users buy products and share files through near field communication.

Code pulled from Pre-EVT (Engineering Verification Testing) iPhone 5,1 and iPhone 5,2 prototypes by 9to5Mac leads the Apple enthusiast site to believe that NFC chips and an antenna will be built into this year's iPhone.

If true, it means Apple would finally jump onto the mobile payments bandwagon, allowing its users to purchase goods and services directly through their smartphones. This latest rumor also comes on top of the company's launch of Passbook, a feature slated for iOS 6 that would let people store electronic versions of receipts, tickets, boarding passes, and other information from merchants.

On its own, Passbook doesn't necessarily need to depend on NFC since it serves more as a repository. But Jim Peters, chief technology officer of air transport technology company SITA, believes Apple will incorporate NFC into Passbook, maybe not at first but certainly down the road.

"There is a lot of debate that NFC will never take off because of all the arguments," Peters told 9to5Mac. "But you need to get ready, this is coming. This is going to happen. By the end of the year the majority of smartphones that you go and buy will have NFC on them. If in October the next iPhone comes out and it has NFC on it, it's game over."

Apple could also hook up with an existing mobile payment service like CitiBank's PayPass or even handle payments on its own through all the credit cards already stored through iTunes, suggests 9to5Mac.

NFC has been touted for its ability to enable mobile payments merely by swiping your smartphone past a merchant's NFC-equipped reader. But the technology potentially offers much more. iPhone owners would be able to swap and share files between different devices, reducing the need to synchronize through iTunes.

Apple has reportedly been working on NFC integration for a while.

A New York Times story from March 2011 confirmed that a future iPhone would include the NFC hardware. Some rumors at the time speculated that last year's iPhone would be NFC-enabled, but obviously those rumors missed the mark.

NFC is still struggling to move beyond its first baby steps. Google has already been playing in this sandbox. Certain Android phones come equipped with the NFC hardware, and the search giant has been pushing its Google Wallet service. So the time seems ripe for Apple to finally enter this nascent market, a development that could give NFC the push it needs to enter the mainstream. View the original article here

Confirmed: The New iPhone Will Have A 19-Pin “Mini” Connector

Although the form factor and actual size are still unknown, TechCrunch has independently verified that Apple is working on adding a 19-pin port, replacing the current 30-pin port, to the new iPhone. It is a move that will surely send shocks through the iPhone accessory ecosystem.

The new port, partially shown in this Mobilefun post as well as in this video, is similar in size to the Thunderbolt port available on many MacBook devices but I’ve been told by three independent manufacturers that the pin-out will be different.

Apple’s 30-pin ports have been the standard since Apple released the third generation iPod. The connectors offered structural stability when connecting to most accessories but it’s clear – especially with the introduction of the MagSafe 2 port – Apple is more concerned with space savings inside each device.

Three independent manufacturers all agreed that the 19-pin dock port is in the works and many accessory manufacturers are facing an uneasy few months as they wait for official news of the standard to be announced. View the original article here

The Next Secrets Of The Web

Editor’s Note: Nir Eyal is a Lecturer in Marketing at the Stanford Graduate School of Business and blogs about the intersection of psychology, technology, and business at NirAndFar.com. Follow him on Twitter @nireyal and see his previous Techcrunch posts here.

Right now, someone is tinkering with a billion dollar secret — they just don’t know it yet. “What people aren’t telling you,” Peter Thiel taught his class at Stanford, “can very often give you great insight as to where you should be directing your attention.”

Secrets people can’t or don’t want to divulge are a common thread behind Thiel’s most lucrative investments such as Facebook and LinkedIn, as well as several other breakout companies of the past decade. The kinds of truths Thiel discusses — the kinds that create billion dollar businesses in just a few years — are not held exclusively by those with deep corporate pockets. In fact, the person most likely to build the next great tech business will likely be a scrappy entrepreneur with a big dream, a sharp mind, and a valuable secret.

Where are the Secrets?

According to Thiel, there are two types of secrets: those about nature and those about people. Thiel dismisses the former as less interesting because they are less practical. “No one really cares about superstring theory. It wouldn’t really change our daily lives if it turned out to be true.”But secrets about people have immediately practical applications. I believe secrets about human behavior, which provide insights into the way people act even though they can’t tell you why, are levers for creating user habits and competitive advantage. These kinds of secrets are also relatively cheap to uncover but can be the basis of massive enterprises.

Once, only large companies had the resources to discover monetizable secrets. Throughout the twentieth century, companies like GE, Dupont, Chrysler, and IBM specialized in discovering the optimal form of physical goods and their insights lay largely hidden in the discipline of industrial design. For these companies, uncovering secrets required massive R&D investment to find the best way to create a better, cheaper, or faster product.

But today, as software continues to eat the world, service industries are being upended by upstarts. A new crop of companies like AirBnB, DropBox, and Square exploits secrets gleaned not from industrial design, but from interaction and systems design. These companies remedy old problems by designing interfaces to create new user behaviors.

Change the Interface, Change the World

Whenever a massive change occurs in the way people interact with technology, expect to find plenty of secrets ripe for harvesting. Changes in interface suddenly make all sorts of behaviors easier. Subsequently, when the effort required to accomplish an action decreases, usage tends to explode.A long history of technology businesses made their fortunes discovering behavioral secrets made visible because of a change in the interface. Apple and Microsoft succeeded by turning DOS terminals into graphical user interfaces accessible by mainstream consumers. Google simplified the search interface, as compared to those of ad-heavy and difficult-to-use competitors like Yahoo. Facebook and Twitter turned new behavioral insights into interfaces that simplified social interactions online. In each case, a new interface made an action easier and uncovered surprising truths about the way users behave.

More recently, Instagram and Pinterest offer examples of companies which capitalized upon behavioral insights brought about from changes in interface. Pinterest’s ability to create a rich canvas of images — utilizing what was then cutting-edge interface changes — revealed new insights about the addictive nature of an online catalog. For Instagram, the interface change was cameras integrated into smart phones. Instagram discovered that its low-tech filters made relatively poor quality photos taken on phones look great. Suddenly taking good pictures on your phone was easier and Instagram used its newly discovered insights to recruit an army of rabidly snapping users. With both Pinterest and Instagram, tiny teams generated huge value, not by cracking hard technical challenges, but by solving interaction problems.

From Discovery to Domination

Along with capitalizing on behavioral insights discovered from a change in interface, Instagram and Pinterest also shared another key attribute. They both grew to stratospheric valuations because they came to dominate their respective markets through a network effect. Defined as a system where each additional user on the network increases the value to all the other users, the network effect is a common trait among record breaking tech business of the past decade.But where the titans of twentieth century industry could build competitive advantage in a number of ways — owning intellectual property, building a brand, deriving scale cost advantages, and the network effect, for example — most young companies today can only afford the last option. The nature of interface-driven innovation is that many of the old competitive advantages don’t work. The byproduct of the massive investment required to building cars and turbines was an increasing market dominance with each sale. Each closed deal spread the fixed costs of protecting patents, building a brand, and manufacturing equipment, thereby making it harder for new entrants to compete.

But today, consumer web startups have no such advantages. They must quickly create habitual users and build a network effect before their competitors do; it’s their only hope. Software production doesn’t offer scale cost advantages, the patent system is a mess startups can’t afford to navigate, and spending on branding prematurely is foolish. Only after a network effect business has secured its place in users’ everyday lives does it make sense to build its brand through advertising. Twitter’s recent foray into television commercials promoting its NASCAR partnership is a good example.

Though we’re living through an age when new insights about user behavior abound, the methods for building a long-term business advantage has narrowed. The kind of secrets that build big businesses today must support a plan to build a network effect business. Without a network effect strategy, secrets don’t stay valuable for long. View the original article here

Monday, June 25, 2012

How to restrict access to all your old Facebook posts

Sure, it’s easy to choose how far and wide to share your latest Facebook updates and photos; all you have to do is pick an option (like “Public,” “Friends,” or “Only Me”) from a nearby pull-down menu.

But what about all those other photos, videos, and updates you’ve posted on Facebook over the years? Lost track of who you’re sharing them with? You’re not the only one.

Well, one (rather tedious) option is to retrace your steps, checking each and every post on your profile to see who you shared them with; just hover over a post with your mouse and check out the icon that appears to the right.

A pair of silhouetted heads means a post is shared with your friends only, while a gear icon represents a custom sharing setting (for, say, a few selected friends, or your friends plus all their friends).

A little globe means … well, everyone.

Want to make a change? Click the icon to select a new setting.

If you’d rather not cull through dozens or even hundreds of old posts, there’s an easy—if somewhat drastic—way to lock them down all at once, so only those on your Friends list can see them.

The process takes just a few clicks, but as Facebook warns, there’s no way to undo it—shy of going back and changing the sharing settings for each post by hand, of course.

Also, keep in mind that any specific Facebook users tagged in your posted photos or content will still be able to see those specific posts—and their friends (including non-mutual ones) may have access to those posts, too.

Clicking a single button will change the privacy settings for all your old Facebook posts at once.

- Click the little downward arrow in the upper-right corner of any Facebook page, then select “Privacy Settings” from the drop-down menu.

- Near the bottom of the page, find the heading that reads “Limit the Audience for Past Posts,” then click the “Manage Past Post Visibility” link right next to it.

- Sure you’re ready to proceed? If so, click the “Limit Old Posts” button.

Subscribe to:

Posts (Atom)